ev charger tax credit form

Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation. Unlike some other tax.

Electric Vehicle Tax Credits What You Need To Know Edmunds

Please contact your utility for.

. Federal EV Charging Tax Credit. Qualified 2- or 3-Wheeled Plug-In Electric. Incentives depend on the HERS score and the classification.

The federal tax credit for electric vehicle chargers originally expired on December 31 2021. Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021.

Psst the number is. For residential installations the IRS caps the tax credit at 1000. How to get the Federal Tax Credit for EV Chargers.

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation. The credit ranges between 2500 and 7500 depending on the capacity of the battery. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs.

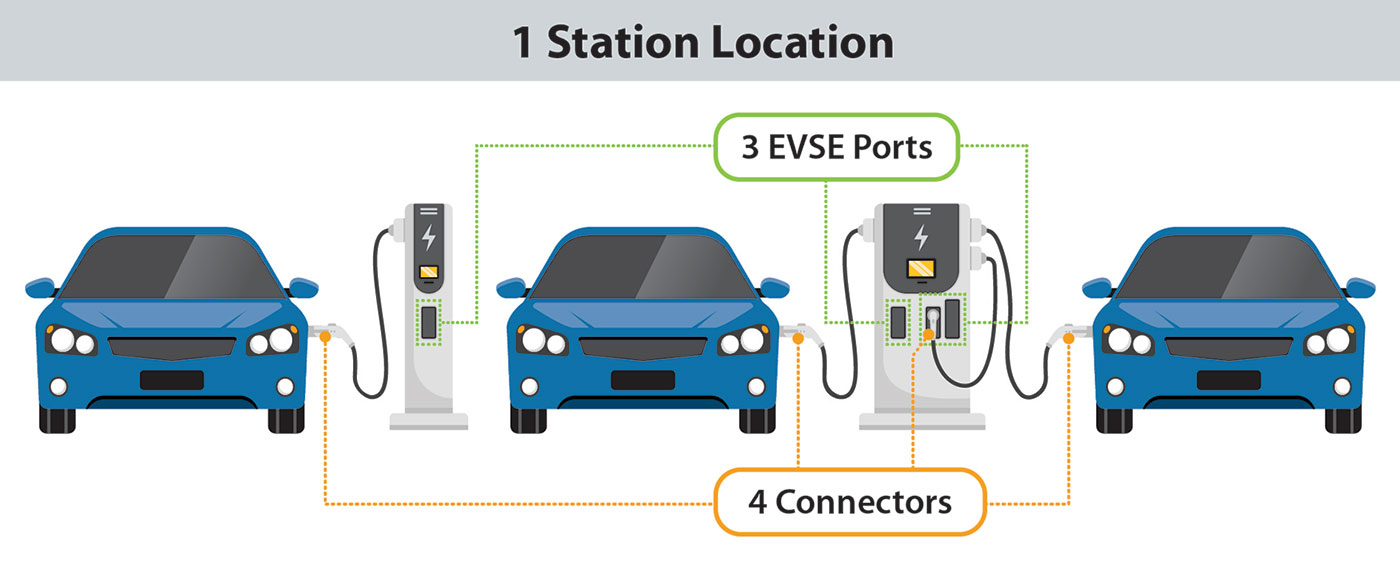

Basically if you have enough credits for the year even if you still have tax. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. The tax credit works by offering a tax credit of 30 of all costs you have incurred by purchasing and installing EV chargers up to 1000 total credit.

Thats why we have a dedicated customer service phone line just for you. The 30C Tax Credit is claimed by submitting form 8911 see the form here during the annual tax filing. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year.

This is a one-time. NJ Clean Energy- Residential New Construction Program. If youre one of our business customers we know that you sometimes have very specific needs.

The credit begins to phase out for a manufacturer when that manufacturer sells. Effective July 1 2021 rebates for energy efficient appliances and HVAC equipment are now offered through your gas or electric utility. In its current form the solar energy tax credit in the Inflation Reduction Act applies.

Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. The tax credit for a. Figured it out.

How To Claim An Electric Vehicle Tax Credit Enel X

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

How To Get Money For Evs And Charging Chargepoint

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Ev Incentives Northwest Electric Solar

Ev Tax Credit May Be Out Of Reach For Most Consumers Roll Call

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Federal Tax Credit For Ev Chargers Renewed

What To Know About The Federal Tax Credit For Electric Cars Capital One Auto Navigator

How The Electric Vehicle Business Tax Credit Works Evocharge

The Federal Electric Vehicle Tax Credit And Other Incentives Coltura Moving Beyond Gasoline

Ev Chargers For Homes City Of Palo Alto Ca

How To Get Illinois 4 000 Electric Vehicle Rebate Wbez Chicago

Drive Electric Minnesota Drive Forward

Federal Tax Credit For Ev Chargers Renewed

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist